Vietnam

- a case study

How

Small and Medium Enterprises (SMES)

are Competing and Beating Their Bigger State-Run Rivals

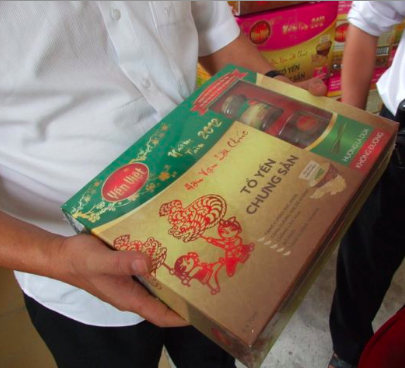

Picture above: the Author Mr. Chris Runckel, President of Runckel & Associates and Mr. Vo Thai Lam, Chairman and General Director of Yen Viet

The nests are farmed or collected from natural caves, without harming the birds. The global market for edible bird's nest was USD3.4 billion in 2010, with supply sufficient to meet only half of demand. Birds nests are one of the world’s more pricey commodities. A good quality birds nest that has been cleaned and processed can cost more than $2,500 per kilo at wholesale. The production of both natural and farmed bird's nest has high entry barriers, given the technical skills required in caring for and helping to nurture a fairly private and quiet loving swiftlet. Supply of natural products in this field cannot be increased significantly, while the farmed segment offers the potential for exponential growth.     Starting from a small operator, Mr. Vo Thai Lam who is also head of the Ninh Thuan Young Entrepreneurs Association has grown this business into a large and active business with multi-million dollar sales and growth rates that would be the envy of most other consumer businesses. He has done that in the face of competition from a large State-owned birds nest company that until recently has held well over 80 percent market share. Today according to Mr. Lam, Yen Viet has over 18 birds nesting houses all over Vietnam. He says the problem for his company is not sales, but it is production as even though he has continually increased his production if he could produce more birds nests he could probably sell them as demand is quite simply strong and growing.   Although Yen Viet now has bird raising and nurturing facilities all over Vietnam, in early 2009, Mr. Lam consolidated his processing facility in a modern newly constructed factory complex we visited at Thanh Hai Industrial Zone, Phan Rang, Thap Chang City, Ninh Thuan. This facility which has a number of modern factory buildings located in a clean and modern designed layout processes birds nest, makes the birds nest drink, has a research lab working on new product development plus a large warehouse for storage and a head office and other facilities.   As will be seen from the pictures, facilities have the most modern imported equipment. Staff we talked to said they were treated well and cleanliness was very high for all aspects of the operation.   In May, 2011, recognizing the promise of this business, VinaCapital’s Vietnam Opportunity Fund Limited (VOF) acquired a minority stake in Yen Viet. VinaCapital besides injecting a sizeable multi-million dollar investment in Yen Viet also agreed to assist the company in strengthening its distribution channels, production capability and product development. In addition, steps will be made to improve corporate governance, strategic planning and to examine the possibility of a listing on a Vietnamese or international stock exchange. This development was a strong vote for the ultimate success of Yen Viet and also gave Yen Viet access to experienced management, sales and marketing, financial and other human resources which VinaCapital has developed that are still in shortage in Vietnam’s rapidly developing economy. VinaCapital in essence seconded several of their staff to lead key marketing and other sections and this has greatly helped to professionalize and internationalize Yen Viet and to prepare it for export sales. VinaCapital is without a doubt the leading investment management and real estate development firm in Vietnam, with a diversified portfolio of nearly 2 billion USD in assets under management. VinaCapital was founded in 2003 and boasts a team of managing directors who bring extensive international finance and investment experience to the firm but also have very developed country specific and cultural specific insights. The mission of the company is to produce superior returns for investors by using the company’s experience and knowledge to identify the key trends and opportunities that emerge as Vietnam continues to develop its economy. To achieve this, VinaCapital has teams covering capital markets, private equity, fixed income, venture capital, real estate and infrastructure. VinaCapital manages three closed-end funds trading on the AIM Market of the London Stock Exchange. These funds are: VinaCapital Vietnam Opportunity Fund Limited (VOF), VinaLand Limited (VNL), and Vietnam Infrastructure Limited (VNI). VinaCapital also co-manages the USD32 million DFJ VinaCapital L.P. technology venture capital fund with Draper Fisher Jurvetson. VinaCapital has offices in Ho Chi Minh City, Hanoi, Danang, Nha Trang, Phnom Penh (Cambodia) and Singapore. More information about VinaCapital is available at www.vinacapital.com. In addition to Yen Viet, the Vietnam Opportunity Fund and VinaCapital hold significant investments in Vietnam's consumer goods sector, including stakes in Vinamilk, Kinh Do Confectionary, and Phu Nhuan Jewelry. In January 2011, the fund sold its stake in Halico, a vodka producer, to Diageo, and in November 2010 it sold its stake in Vinacafe, an instant coffee producer. Over the last several years according to some sources, VinaCapital has invested well over a half billion dollars in the consumer sector in Vietnam and is continuing to help this sector to develop both through investments and also just as importantly by sound consultation and often provision of human resources where needed.  Yen Viet is an example of how Vietnam’s business environment is continuing to change. Companies that 5 years ago were small and unstable are now much more experienced and self sufficient. The top level companies are already starting to separate from the vast pack below and companies like VinaCapital and others are helping these companies with the basics for advancement to secure the capital, human resources and other key ingredients to advance and prosper. Related News: VinaCapital invests in bird’s nest firm Our other related articles:

About the Author: Christopher W. Runckel, a former senior US diplomat who served in many counties in Asia, is a graduate of the University of Oregon and Lewis and Clark Law School. He served as Deputy General Counsel of President Gerald Ford’s Presidential Clemency Board. Mr. Runckel is the principal and founder of Runckel & Associates, a Portland, Oregon based consulting company that assists businesses expand business opportunities in Asia. (www.business-in-asia.com) Until April of 1999, Mr. Runckel was Minister-Counselor of the US Embassy in Beijing, China. Mr. Runckel lived and worked in Thailand for over six years. He was the first permanently assigned U.S. diplomat to return to Vietnam after the Vietnam War. In 1997, he was awarded the U.S. Department of States highest award for service, the Distinguished Honor Award, for his contribution to improving U.S.-Vietnam relations. |