The Philippines: Outlook Into 2012

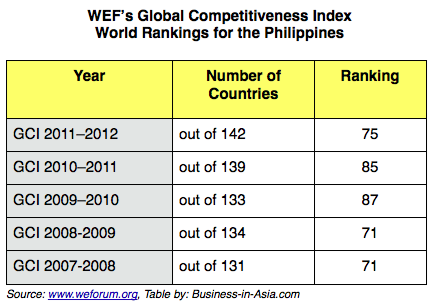

WEF's comments: Source: The World Economic Forum (WEF): The Global Competitiveness Report (GCI) “Up 10

places to 75th, the Philippines posted one of the largest

improvements in this year’s rankings. The vast majority of individual

indicators composing the GCI improved, sometimes markedly. Yet the

challenges are many, especially in the areas at the foundation of any

competitive economy, even at an early stage of development.

- The quality of the country’s public institutions continues to be assessed as poor: the Philippines ranks beyond the 100 mark on each of the 16 related indicators. Issues of corruption and physical security appear particularly acute (127th and 117th, respectively). The state of its infrastructure is improving marginally, but not nearly fast enough to meet the needs of the business sector. The country ranks a mediocre 113th for the overall state of its infrastructure, with particularly low marks for the quality of its seaport (123rd) and airport infrastructure (115th). - Finally, despite an enrollment rate of around 90 percent, primary education is characterized by low-quality standards (110th). - Against such weaknesses, the macroeconomic situation of the Philippines is more positive: the country is up 14 places to 54th in the macroeconomic environment pillar, thanks to slightly lower public deficit and debt, an improved country credit rating, and inflation that remains under control. - In the other, more complex pillars of the index, the Philippines continues to have a vast opportunity for improvement. In particular, the largely inflexible and inefficient labor market (113th) has shown very little progress over the past four years. - On a more positive note, the country ranks a good 57th in the business sophistication category, thanks to a large quantity of local suppliers, the existence of numerous and well-developed clusters, and an increased presence of Filipino businesses in the higher segments of the value chain. - Finally, the sheer size of the domestic market (36th) confers a notable competitive advantage." Our Comments: - The Philippines was the biggest gainer among members of the Association of Southeast Asian Nations (ASEAN) included in the index and among the top 10 biggest gainers in the index. Despite the country’s improved ranking, it still was behind many of its Asian neighbors but the shear movement does demonstrate that in large part things are improving.

- The high scores for Philippines were

in non-banking financial

services and in financial markets. However, the Philippines failed to

convince the WEF that the local business environment was as conducive

to doing business compared with other countries in the region. The

lowest rankings of the country were in business environment where it

was ranked No. 55, and in financial access No. 50.

- The country’s relative lack of physical infrastructures such as grain silos or farm-to-market roads, for example, also help keep the Philippines a fairly expensive place to commit long-haul investments, according to the WEF. Its business environment and financial access continue to hinder its development. A weak business environment is the result of lack of infrastructure and an extremely high cost of doing business. - Other impediments include limitations in financial access in areas such as foreign direct investment and the total number of ATMs,” the report stated. - English is an advantage. Filipinos are known the world over for their ability to speak English. English is almost uniformly spoken and understood in the Philippines. This makes it easier to do business. Additionally, the Filipinos probably better understands US culture than any other Asian country. The business process outsourcing (bpo) sector is one of the bright spots in the Philippine economy and greatly reflects the above facts (read our article, "Asia's Top Outsourcing Cities") Recently, the Philippines' Board of

Investments (BoI) signed an

agreement with computing giant IBM Philippines to eventually put up a

facility that will train existing and potential business process

outsourcing personnel in languages other than English, reported The

Philippines Star. The plan for the training facility is part of

the BoI-IBM partnership dubbed “Philippines as the Global Leader in

Multilingual BPO.” Its aim is to improve proficiency in Mandarin,

Nihongo, French, German and Spanish. The Philippines currently

has a limited supply of multilingual talents to address the burgeoning

demand. In Metro Manila, for example, there were only around

9,000 multilingual individuals (other than English and Tagalog), and

not all of them were doing BPO work, according to the BoI. This aligns

with the global trend of shifting and diversifying the BPO sector’s

client portfolio beyond the US and other English-speaking countries.

- According to the Goldman Sachs investment bank, the Philippines is among the N-11 (Next 11) economies that are likely to advance to the stage of “growth countries,” or nations that account for at least one percent of global gross domestic product, reported the Philippine Daily Inquirer. Korea, Indonesia, Philippines and Vietnam are the N-11 economies in Asia. Goldman Sachs said that, except for Vietnam and Bangladesh, all N-11 economies could advance to the “growth” classification. The nine economies from the N-11, along with the so-called BRICs (Brazil, Russia, India and China), are expected to contribute the most to global growth from 2011 to 2020. - In the 1970s if you had asked anyone which nation in SE Asia will be the next economic success story, most people would have named the Philippines. Unfortunately, the Philippines because a combination of reasons never reached the potential most thought was there. In 2012, the economy still faces many challenges but as the WEF report notes, conditions are improving. As we have noted repeatedly of late - the Philippines is definitely worth a second look in many sectors. About the Author: Christopher W. Runckel, a former senior US diplomat who served in many counties in Asia, is a graduate of the University of Oregon and Lewis and Clark Law School. He served as Deputy General Counsel of President Gerald Ford’s Presidential Clemency Board. Mr. Runckel is the principal and founder of Runckel & Associates, a Portland, Oregon based consulting company that assists businesses expand business opportunities in Asia. (www.business-in-asia.com) Until April of 1999, Mr. Runckel was Minister-Counselor of the US Embassy in Beijing, China. Mr. Runckel lived and worked in Thailand for over six years. He was the first permanently assigned U.S. diplomat to return to Vietnam after the Vietnam War. In 1997, he was awarded the U.S. Department of States highest award for service, the Distinguished Honor Award, for his contribution to improving U.S.-Vietnam relations. |